The threat of tariffs looms over AI startups; the wars for talent in Europe; AI annotation becomes viable gig for students; apps are the hottest AI companies

Chief Hugging Face scientist compares AI models to "yes-men on servers"; McDonald's gives its restaurants an AI makeover; AI tools are reshaping coding; AI copyright wards need a market-based solution

As part of my role as head of corporate affairs at Synthesia, I took part in a roundtable this week with representatives from the UK government to discuss how mid-sized and challenger tech companies are feeling about the year ahead, and what competition-related issues scaleups and startups face in the UK and globally.

Most of my policy peers in the room focused on the Digital Markets, Competition and Consumers Act (DMCCA), a piece of legislation that received Royal Ascent in 2024 with multi-partisan support, and represents the UK’s (much better, in my view) response to the European Union’s Digital Markets Act (DMA).

While the DMCCA is important, especially for smaller companies reliant on Big Tech platforms for services such as payments or app store distribution, I used my time to remind everyone that, for the next four years (and potentially, the next decade), companies and governments will need to operate in a deeply protectionist environment, shaped by a potentially long and painful tariff-based trade war between the United States and China, with very clear ramifications for the world's most innovative sector: artificial intelligence. As a result, it will be this trade war that will stifle competition and economic growth, rather than the market monopolies and anti-consumer behaviors that policy makers have had to deal with for the past decade.

At first glance, tariffs targeting semiconductors, computing hardware, and technology imports appear to serve a specific geopolitical goal: slowing down China so the United States can establish itself as the “AI golden standard,” as vice-president JD Vance stated in his speech at the AI Impact Summit in Paris.

But for AI startups, ranging from small-scale wrapper applications built atop major cloud services to billion-dollar foundation model developers, the tariffs could impose hidden costs that set innovation back by years.

Take AI hardware, for instance. High-performance GPUs and other advanced chips are essential for AI model training and inference, with many startups and academic institutions relying heavily on data centers filled with Nvidia’s hardware. The imposition of tariffs, sometimes adding up to tens of millions of dollars in extra cost, forces smaller AI developers to reconsider ambitious projects or settle for inferior technology. US-based companies like OpenAI and Anthropic awash with VC funding can weather the storm thanks to exclusive deals with Big Tech cloud providers, but promising new entrants from other parts of the world will face rising barriers, as the Trump administration rethinks its trade agreements with the European Union, Canada or Japan.

Additionally, large tech companies such as Google, Microsoft, and Amazon will face higher costs that erode margins and limit their willingness to invest heavily in global AI infrastructure. Reduced capital expenditures from these giants outside the United States mean fewer cloud resources and infrastructure investments trickle down to the broader AI ecosystem, further limiting innovation. To date, startups outside the US have managed this problem by relying on international data transfers which comply with data protection regulations. For example, European startups use Standard Contractual Clauses (SCCs) to run AI workloads in American data centers which are equipped with newer GPUs compared to their European equivalents. But if SCCs become a victim of the trade war (see JD Vance’s comments below on his administration’s views on AI and data regulation), European startups will have no choice but to rely on the scant AI compute resources available on the continent.

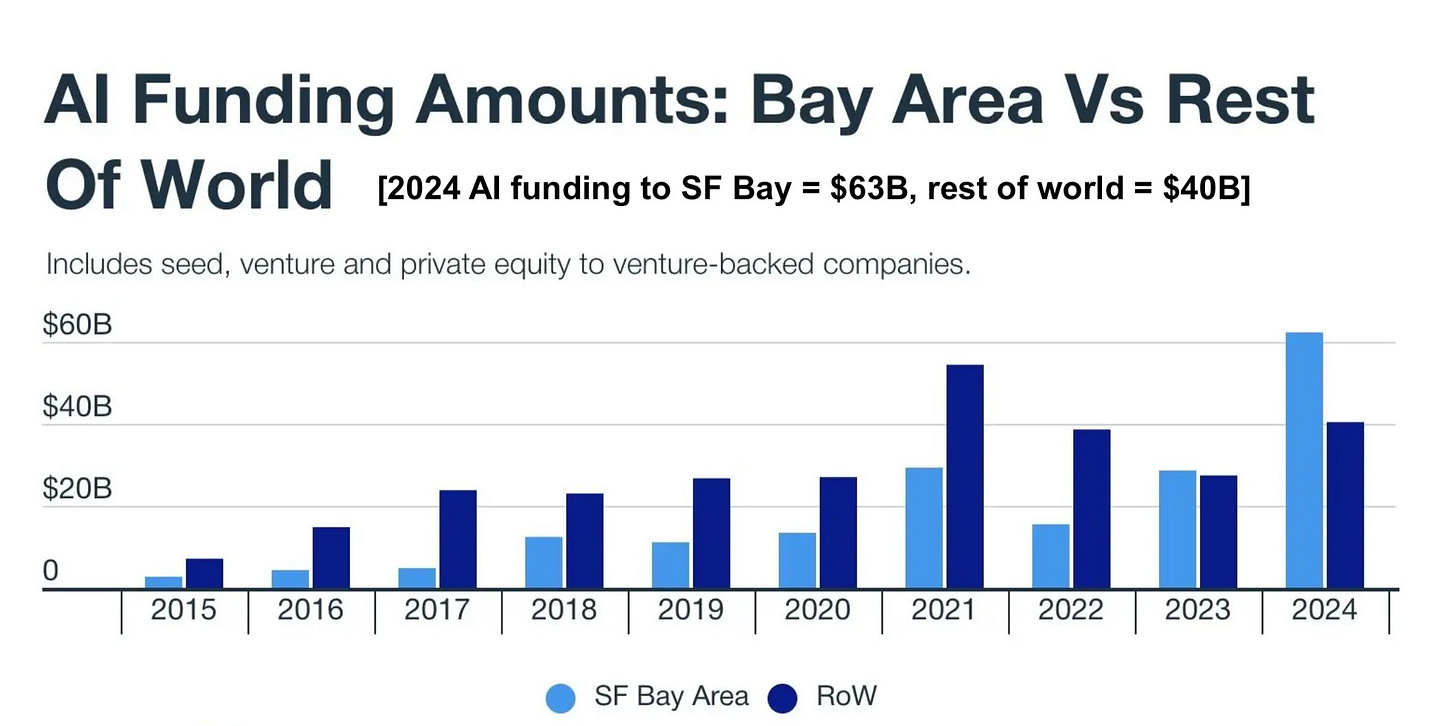

Moreover, the tariffs will have downstream economic ripples. Higher costs will drive inflation, prompting central banks to hike interest rates again. The result would be a tighter capital market, leaving fewer dollars for AI startups already burdened by increased operational costs. There’s already a huge imbalance between funding in the United States and Europe (with startups in San Francisco alone receiving much more funding than the rest of the world combined), so we could be risking a significant deceleration in global AI innovation at the worst possible time.

Ultimately, tariffs meant as tactical tools in geopolitical rivalries will backfire on innovation, with non-US AI companies being the first collateral damage. The downstream consequences—tighter capital, reduced big-tech infrastructure spending, and constraints on resources—could create a feedback loop that stunts AI growth and entrenches market power in fewer, wealthier hands.

Policymakers need to recognize that tariffs in tech might not just raise prices; they could alter the trajectory of AI itself, shaping the global competitive landscape for decades to come.

Luckily, it’s not all doom and gloom. While Europe has lagged behind on innovation, it has been a world leader in one particular field: protectionism. In areas such as agriculture or automotive, the European Union has perfected the art of the diplomatically-imposed tariff, without igniting global or regional trade wars. If the same strategy can be deployed successfully in the technology sector, it might just give local AI champions enough time to survive the wrath of the current United States administration and compete globally in certain sectors, such as defense or drug development.

The other card in Europe’s pocket is the ability to offer state support for struggling industries. Compute is of course important for AI startups but data is equally useful. So Europe could mobilize itself at the regional and national level, and give European startups preferential access to large data sets in order to increase their competitiveness.

And now, here are the week’s news:

❤️Computer loves

Our top news picks for the week - your essential reading from the world of AI

Sifted: AI talent crisis: How European startups are looking to outcompete rivals for tech workers

Forbes: A Growing Side Hustle For American College Grads: Fixing AI’s Wrong Answers

TechCrunch: Hugging Face’s chief science officer worries AI is becoming ‘yes-men on servers’

Business Insider: While the US and China compete for AI dominance, Russia's leading model lags behind

The Information: How Meta and Google Benefit From AI-Created Ads—Made With Other Firms’ Technology

TechCrunch: Experts don’t think AI is ready to be a ‘co-scientist’

MIT Technology Review: How DeepSeek became a fortune teller for China’s youth

FT: AI companies race to use ‘distillation’ to produce cheaper models

WSJ: Google’s New Tech Means Video Calls May Not Be the Death of Us After All

Bloomberg: Trump’s Funding Cuts Threaten America’s AI Competitiveness