The 2025 State of AI Report shows an industry maturing; business leaders learn to live in the AI bubble; Sora 2 reignites AI slop debate; how AI became personal assistants; updates from OpenAI DevDay

A startup aims to create a new DeepSeek moment; ASML exec slams EU AI overregulation; AI is now in every industry; AI toys and sexy chatbots come to America; how AI is changing white-collar work

An AI hangover made landfall in mid-August when a widely shared MIT study suggested that 95% of corporate generative AI pilots are failing to move the P&L. A lot of ink was spilled on it, some analysts clutched their pearls, and a thousand board decks sprouted a new slide titled “Reality Check.”

The study’s topline: despite tens of billions poured into generative AI, only a thin sliver of projects deliver measurable financial returns; the rest stall in proof-of-concept purgatory, especially when companies try to build everything themselves rather than buy focused tools. The methodology leaned on interviews, surveys and public disclosures, and the verdict was grim enough to fuel a week of human slop (podcasts, newsletters, etc.) from the usual AI grifters.

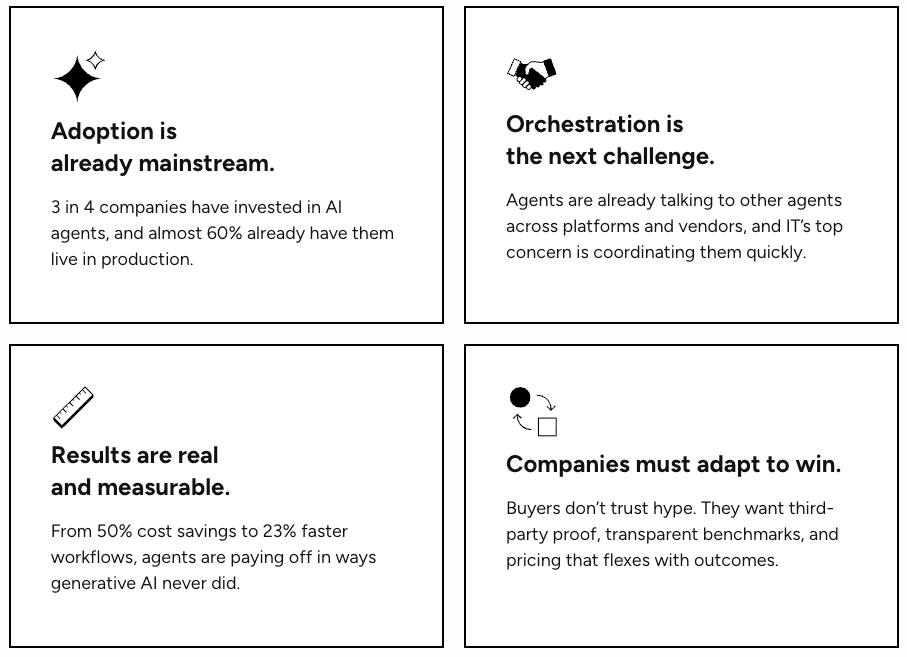

But before we declare an AI winter, it’s worth reading the fine print and then looking at more data. For example, new G2 data published this week reveals the MIT narrative conflates yesterday’s bespoke chatbot experiments with today’s agentic systems that actually run in production. According to G2’s survey of more than 1,300 B2B decision-makers, nearly 60% of companies already have AI agents in production, satisfaction is high, and post-deployment failure rates are closer to 2% than 95%. While early generative AI pilots often died on the vine, agents embedded in workflows are sticking, saving money and speeding work, especially with a human in the loop.

Slides 98 to 104 from the State of AI Report produced by AI investor Nathan Benaich and Air Street Capital tell a similar story of real-world adoption: AI-first companies are now throwing off real revenue, well into the tens of billions on an annualized basis.

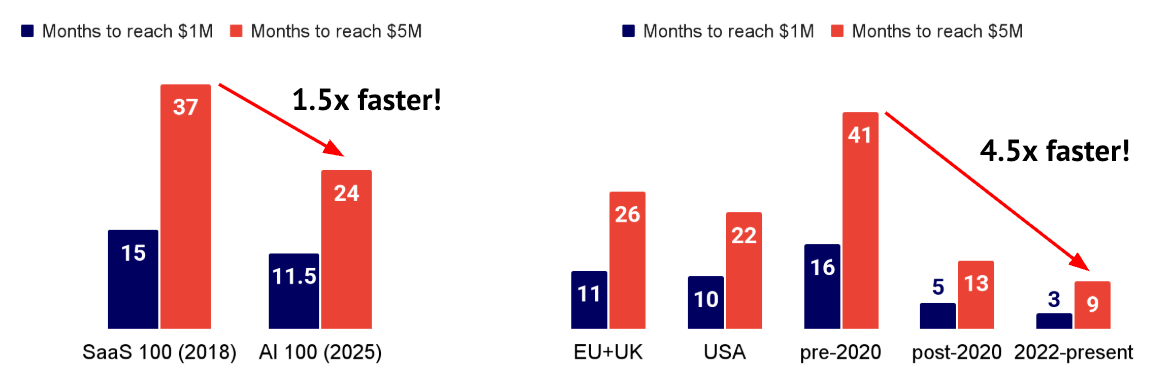

The most compelling part is the shape of the growth curve. Stripe’s AI 100 cohort (the 100 fastest revenue growing AI companies) is reaching $5 million ARR roughly 1.5x faster than the last great software archetype (the top 100 SaaS companies circa 2018). The generational pull of generative AI products is obvious in the cohorts founded after 2022, which sprint to early scale far faster than their pre-ChatGPT peers. In other words: when the product is natively AI, the go-to-market velocity looks different and better.

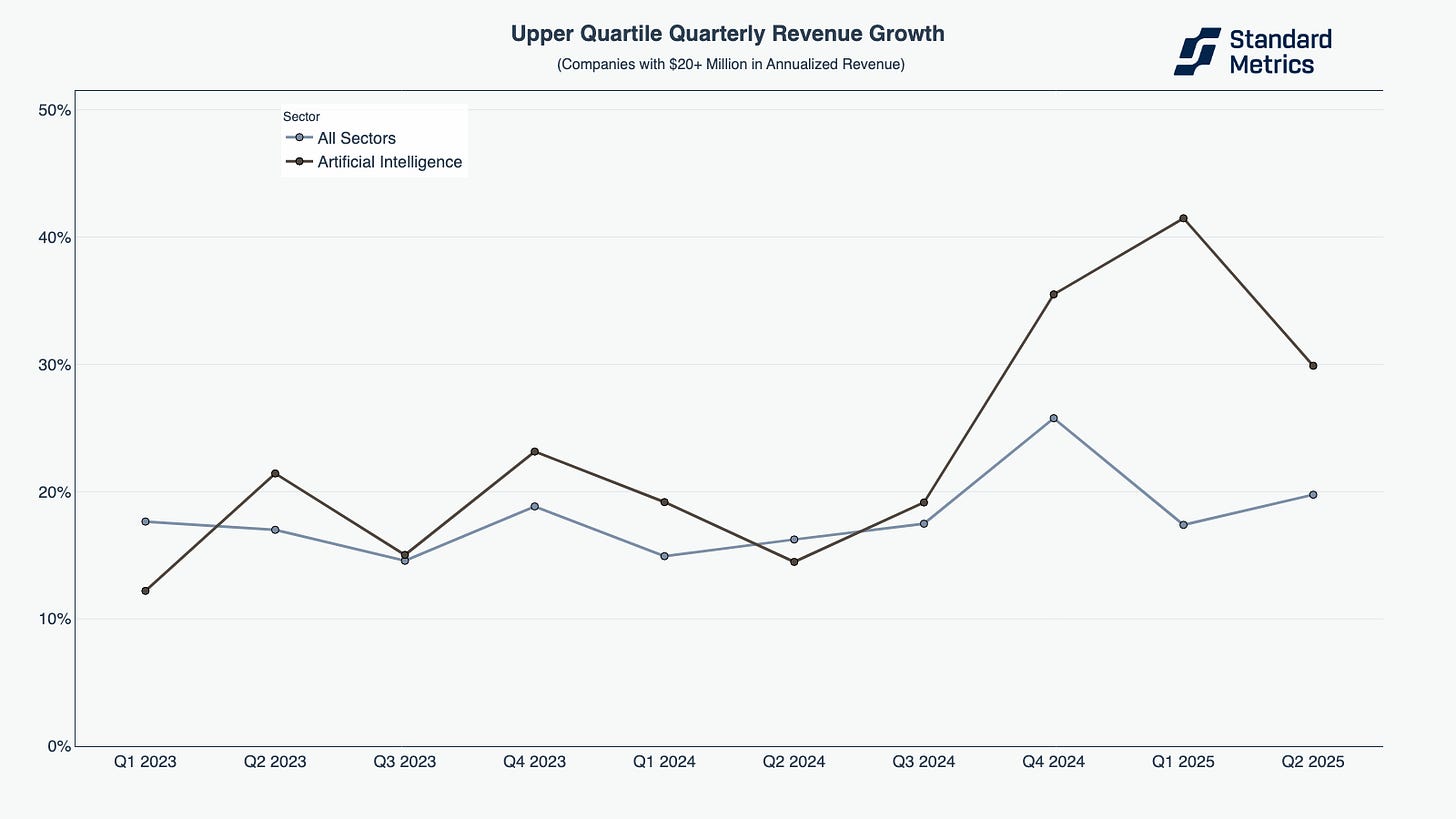

That acceleration doesn’t fade as companies mature. Across a broad sample of AI vendors, those in the $1–20 million bracket and those above $20 million have outgrown all-sector averages quarter after quarter since late 2023. The pattern is consistent: AI-first firms don’t just pop early, they keep outrunning their neighbors as they add products, expand seats and compound usage. For investors thinking about durability, that’s the signal to separate hype from habit.

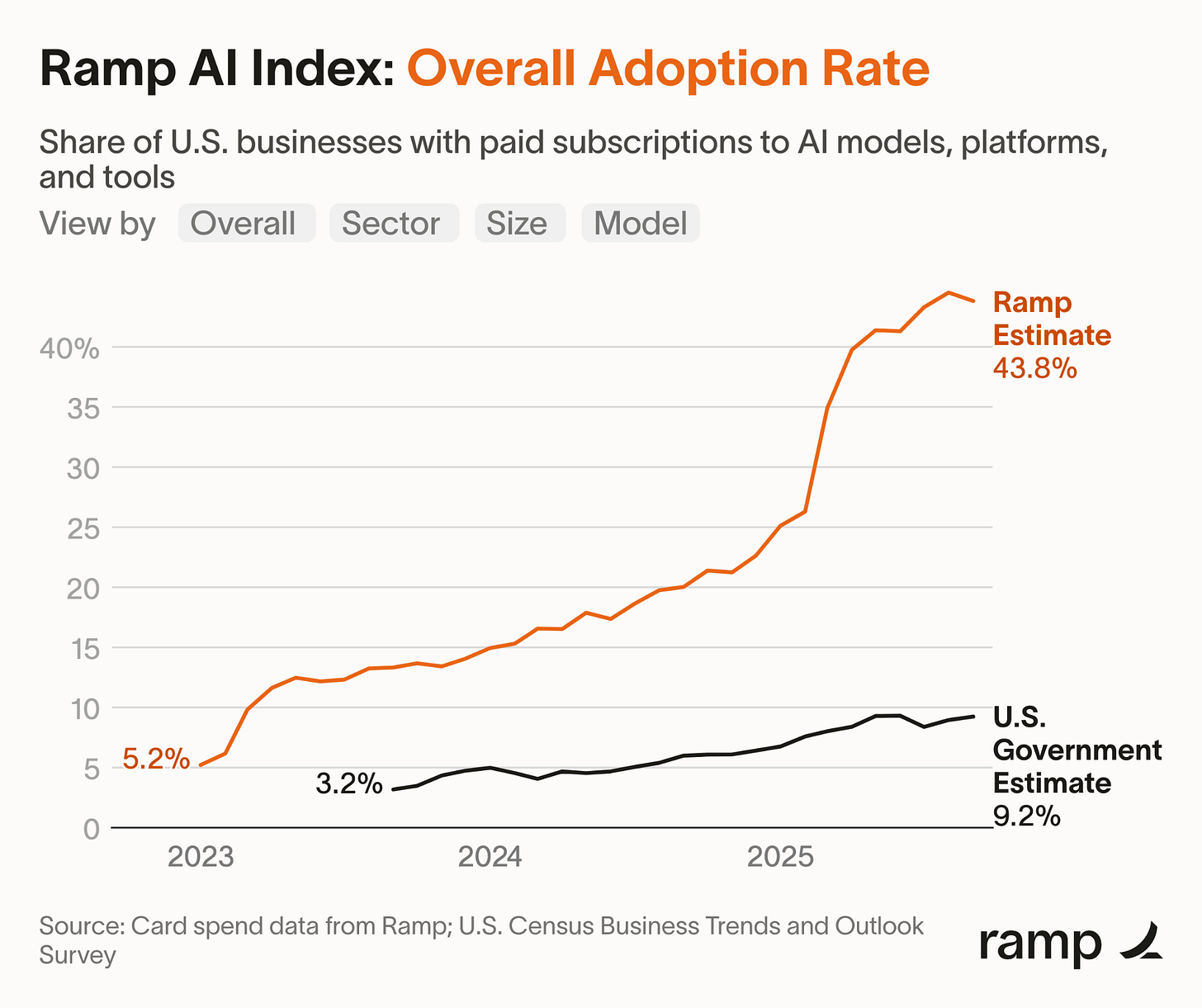

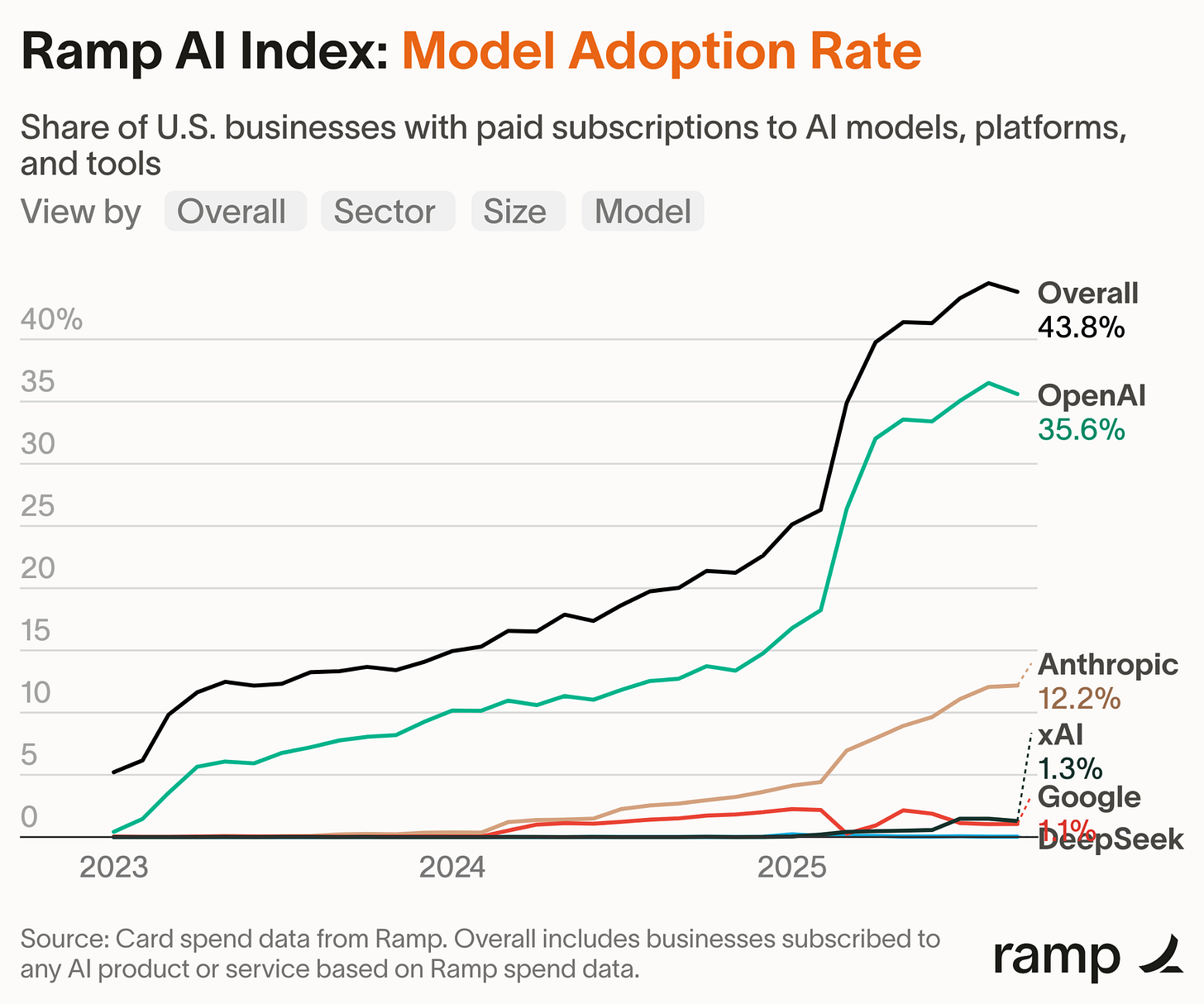

Adoption is also doing something unfashionable for a bubble: it’s compounding. Card and bill-pay data from tens of thousands of U.S. businesses show paid AI adoption climbing from low single digits in early 2023 to north of 40% by September 2025.

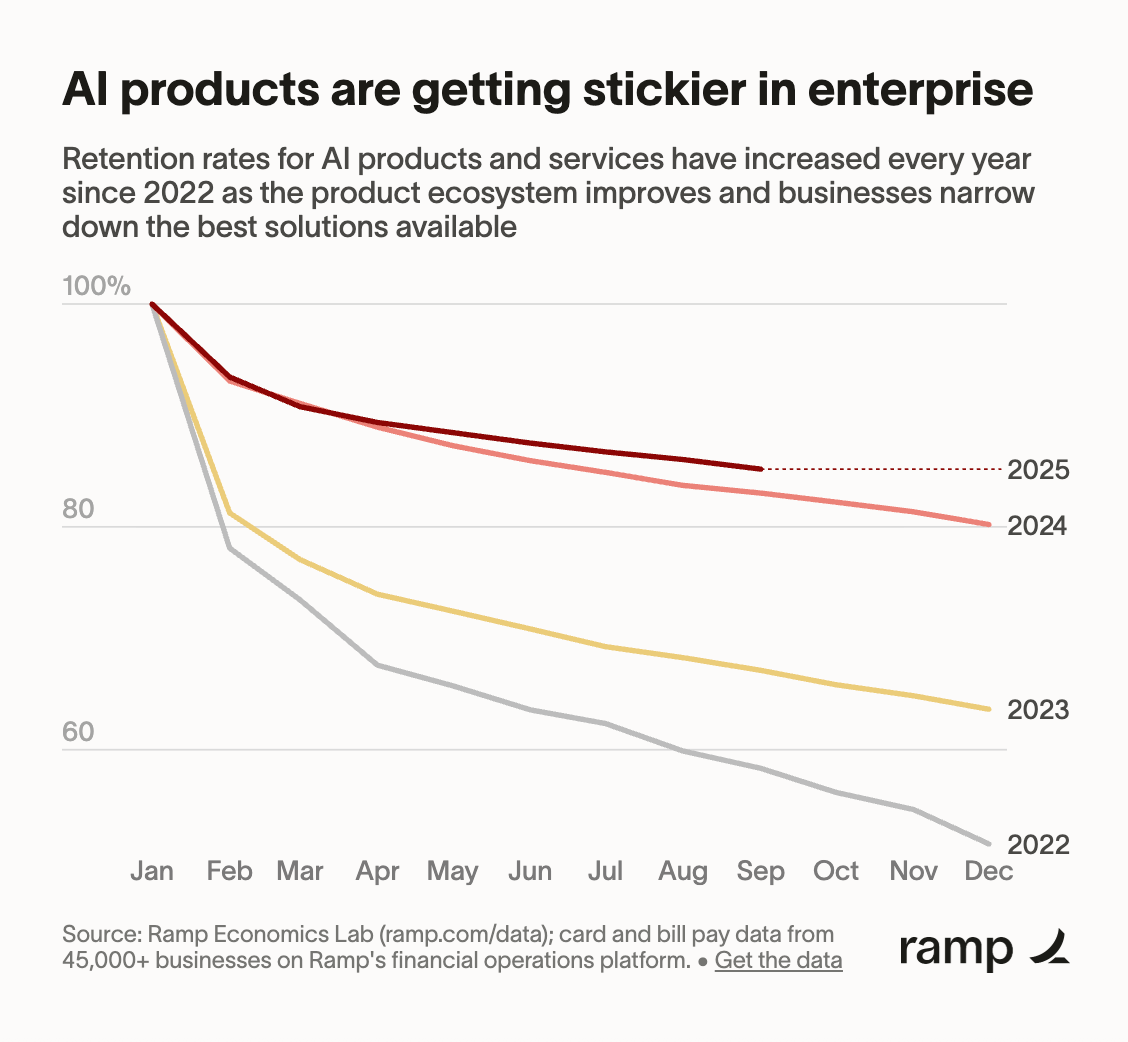

Twelve month retention improved markedly versus 2022, while average contract values jumped from the tens of thousands in 2023 to the mid-six figures in 2025, with seven-figure deals in sight for 2026.

And the model leaderboard is, for now, a one-horse race: OpenAI remains the most-used provider by a wide margin, with Anthropic a distant second and everyone else in the peloton. Pilot projects are turning into line items, and budgets are following suit.

Meanwhile, applied AI companies are exiting the novelty phase and entering the boring revenue era. In audio, avatars and image generation, category leaders are now well into the hundreds of millions of annual revenue, with improving mix as enterprise accounts dominate alongside a very long tail. ElevenLabs doubled revenue in nine months to roughly $200 million and closed a multi-billion valuation; Synthesia crossed $100 million ARR with deep Fortune 100 penetration; Black Forest Labs is around the $100 million ARR mark on hefty margins, buoyed by large-ticket partnerships. These numbers point to potential generational businesses entering a new phase of growth.

So what did the MIT report get wrong? Not necessarily the diagnosis of early failure. It captured a moment when corporate AI was a science fair: scattered pilots, thin integration, and heroic promises made by teams without budget authority. Where it misleads is in extrapolating that snapshot to the present tense. The market has shifted from “play with a model” to “deploy a workflow,” from bespoke builds to opinionated products, and from experiments owned by innovation teams to opex owned by line managers in IT. When your unit of analysis moves from press releases to purchase orders, success rates look very different.

The policy takeaway is not pump the brakes, but do the plumbing. The companies showing real ROI are AI-first by design: they ship tightly scoped products, instrument the outcomes, and iterate with humans in the loop. The capital markets are beginning to price that operating discipline. In aggregate, the class now throws off tens of billions annually, with leading providers consolidating share as adoption broadens and standardizes around a small set of foundation models (chiefly OpenAI’s).

The bottom line for executives: stop litigating whether AI works in the abstract and start measuring whether your workflows do. If the pilots are stuck, it’s probably because they never left the lab. If they’re working, you’ll see it the old-fashioned way: in revenue that arrives faster than SaaS benchmarks, cohorts that retain better than they used to, and contracts that renew bigger than they started.

The market is moving on from demos to dividends. It’s time your roadmap did, too.

And now, here are this week’s news:

❤️Computer loves

Our top news picks for the week - your essential reading from the world of AI

Forbes: This Former SpaceX Engineer Is Using AI To Design Circuit Boards

Bloomberg: The Real AI Risk is ‘Meh’ Technology That Takes Jobs and Annoys Us All

Fortune: How business leaders can survive a ‘phenomenal’ AI bubble

Politico: Dutch chips star exec slams EU for overregulating AI

Fortune: AI came from tech, but the most advanced AI businesses are in every industry

MIT Technology Review: AI toys are all the rage in China—and now they’re appearing on shelves in the US too

The New York Times: How Elon Musk Is Bringing Sexy A.I. Chatbots to the Mainstream

The Information: Founders Fund Shifts From Caution to Concentrated Bets on AI

The Verge: All of the updates from OpenAI DevDay 2025

Wired: OpenAI Wants ChatGPT to Be Your Future Operating System