European tech is making a comeback, according to Accel; workplace influencers drive AI adoption; inside Microsoft's mega data center; AI is upending jobs; AI relationships are on the rise

AI companies want to change ticket sales; data centers are becoming a political issue on the left; EU plans to streamline rules on AI and data; OpenAI moving into consumer healthcare;

If you spend enough time with the AI bros on X, you might get the feeling that the United States has already won the AI race. Six trillion-dollar tech giants dominate the NASDAQ, US AI labs are raising eye-watering rounds for frontier models, and Sam Altman is out giving trillion-dollar-capex speeches. But if you zoom in on the application layer where AI actually touches real workflows, Europe is quietly punching far above its weight.

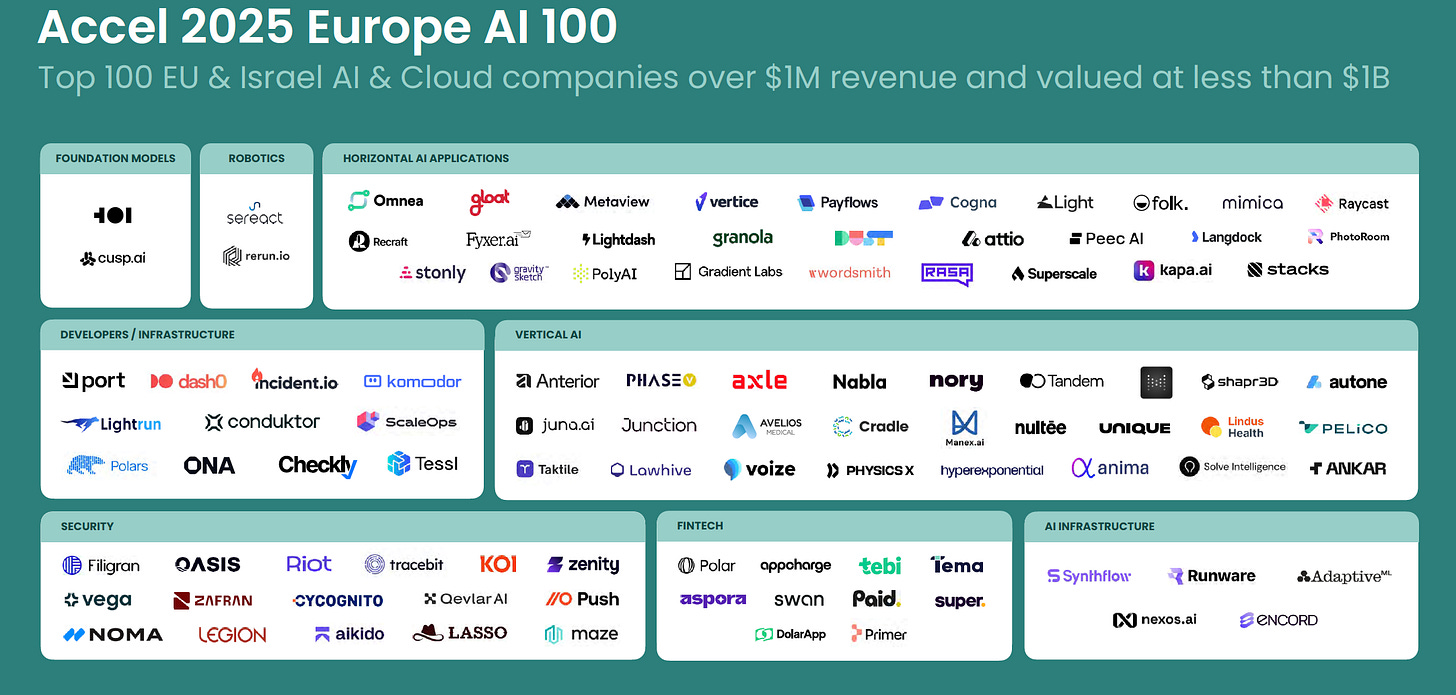

A new report from Accel gives a data-rich snapshot of that landscape. It shows a world where US companies overwhelmingly dominate model building and hyperscale infrastructure, while European and Israeli startups are rapidly catching up, and sometimes almost match US levels, when it comes to cloud and AI applications.

Most people will chalk that up to familiar explanations: Europe’s strong technical universities, a dense industrial base that’s hungry for automation, and policy tailwinds around trusted AI. All true. But there’s another, more nuanced reason that I think matters just as much: US companies are paying what I like to call the ASI hype tax, and European companies mostly aren’t.

By ASI hype tax, I don’t mean GPU bills or cloud credits. I mean something more human and messier: salary inflation, bidding wars, and relentless talent poaching driven by the belief that whoever gets to artificial superintelligence first gets to own the future. That hype shows up as higher operating expenses and higher employee churn, two things that are especially painful in a young, fast-moving industry where institutional knowledge and culture are still being built.

Europe, for now, is getting a discount.

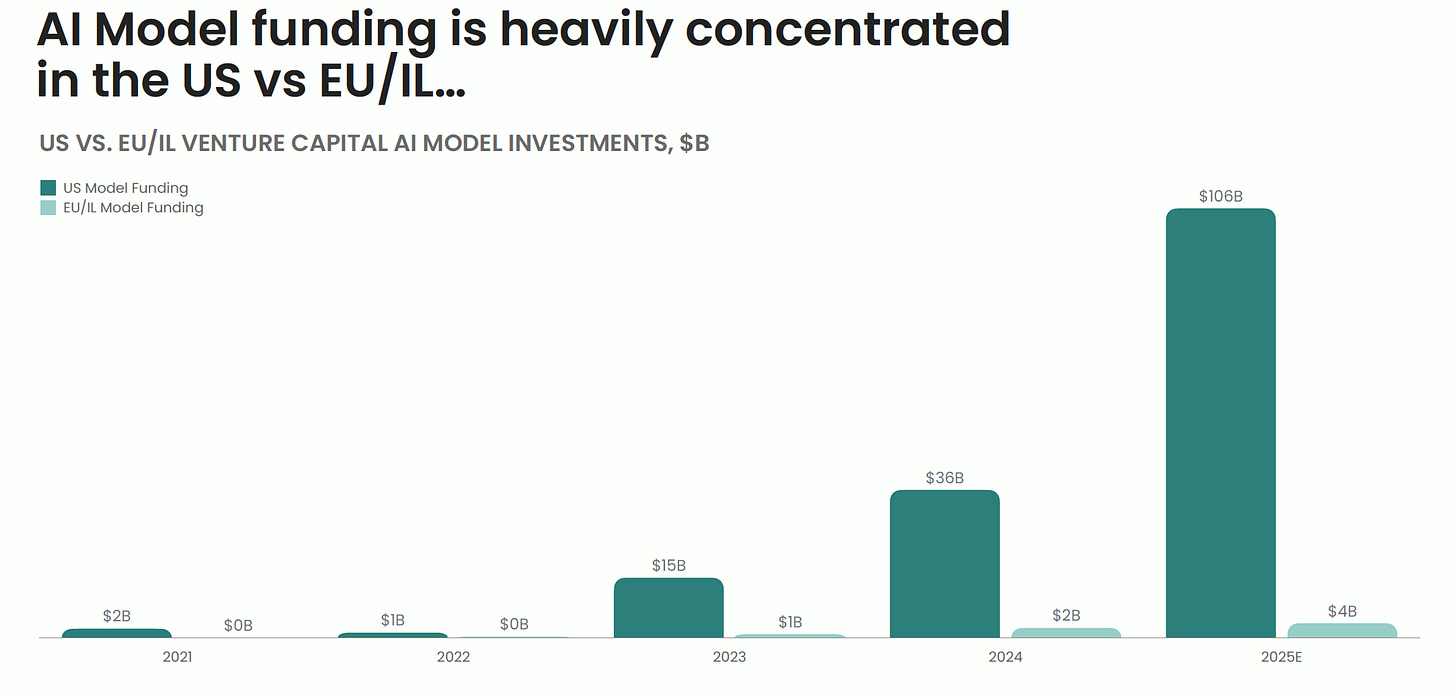

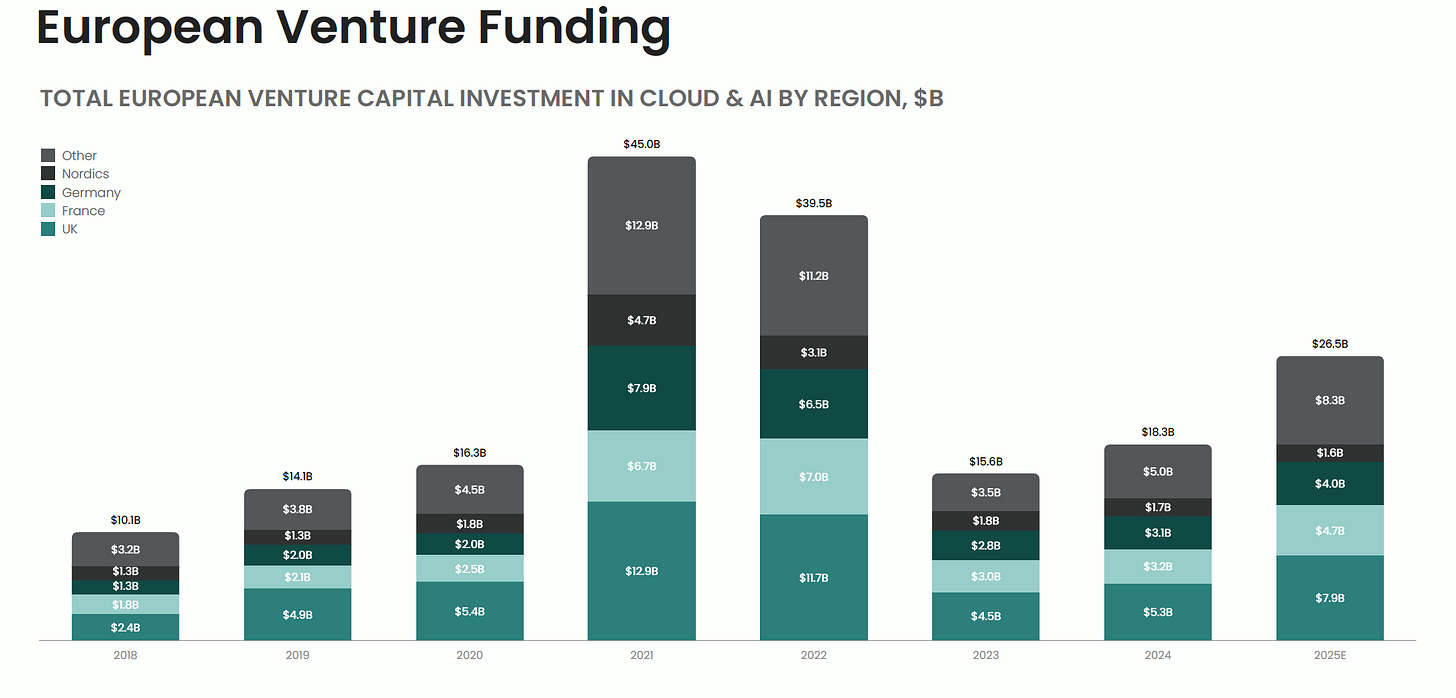

Let’s start with the capital flows. On the model side, the Globalscape report is blunt: US model builders have sucked up almost all the oxygen. From 2021 onward, AI model funding in the US has run into the tens of billions annually, while Europe and Israel have raised only a tiny fraction of that. For example, 2025’s big rounds are dominated by OpenAI, Anthropic, xAI and a handful of other US players, with European model rounds an order of magnitude smaller.

In total, US AI model funding vastly outweighs EU/IL model funding over the 2021–2025 period. That capital isn’t just buying H100s and data center space, it’s also bidding up researchers, engineers, and product leaders. If you’re a senior AI engineer in San Francisco, your inbox has essentially been a live auction for the past 12 months.

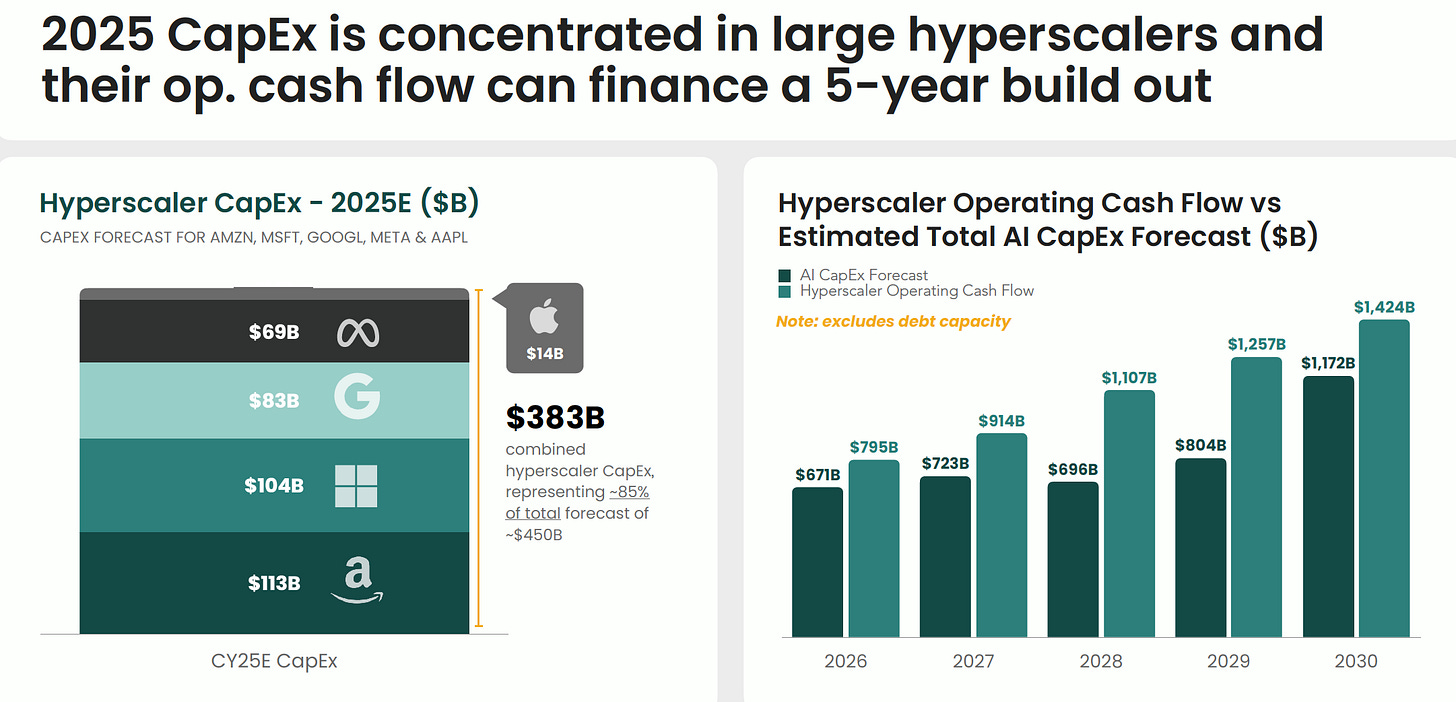

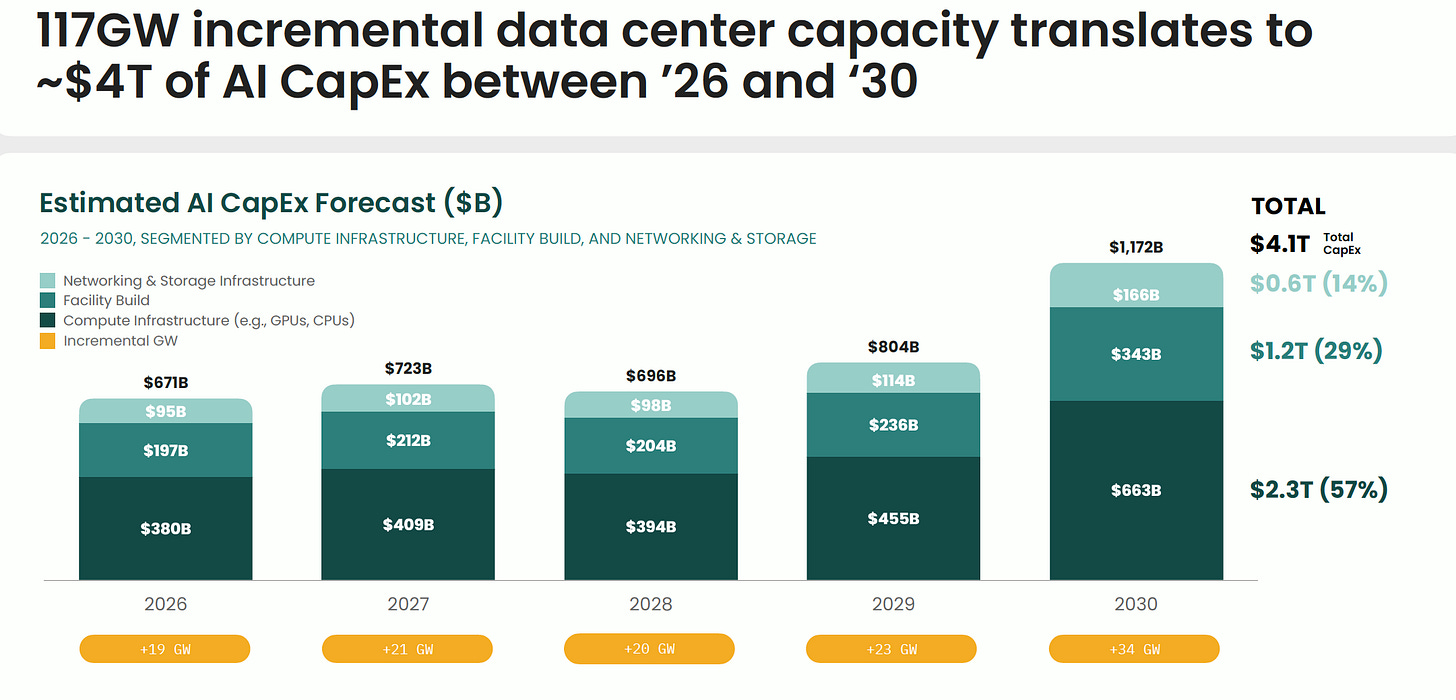

Accel frames this as part of a “race for compute,” a multi-trillion-dollar build-out of AI data centers that could reach about 117 additional gigawatts of capacity by 2030 and roughly $4.1 trillion in capex between 2026 and 2030. That race is being led, and largely financed, by US hyperscalers whose combined operating cash flow is big enough to underwrite years of this spending.

When so much capital and narrative energy is concentrated at the very top of the stack, you get a predictable side effect: intense competition for a relatively small pool of elite talent that can exploit that compute, and compensation expectations that increase with every new mega-round or model launch. That’s where we see the ASI hype tax in action.

And that tax doesn’t stay neatly inside the model labs. It bleeds into the entire US ecosystem. Application-layer startups in the Bay Area are competing for many of the same people, in the same cities, at the same inflated price points, and often watching their best people get poached by a lab or a hyperscaler the moment they prove themselves.

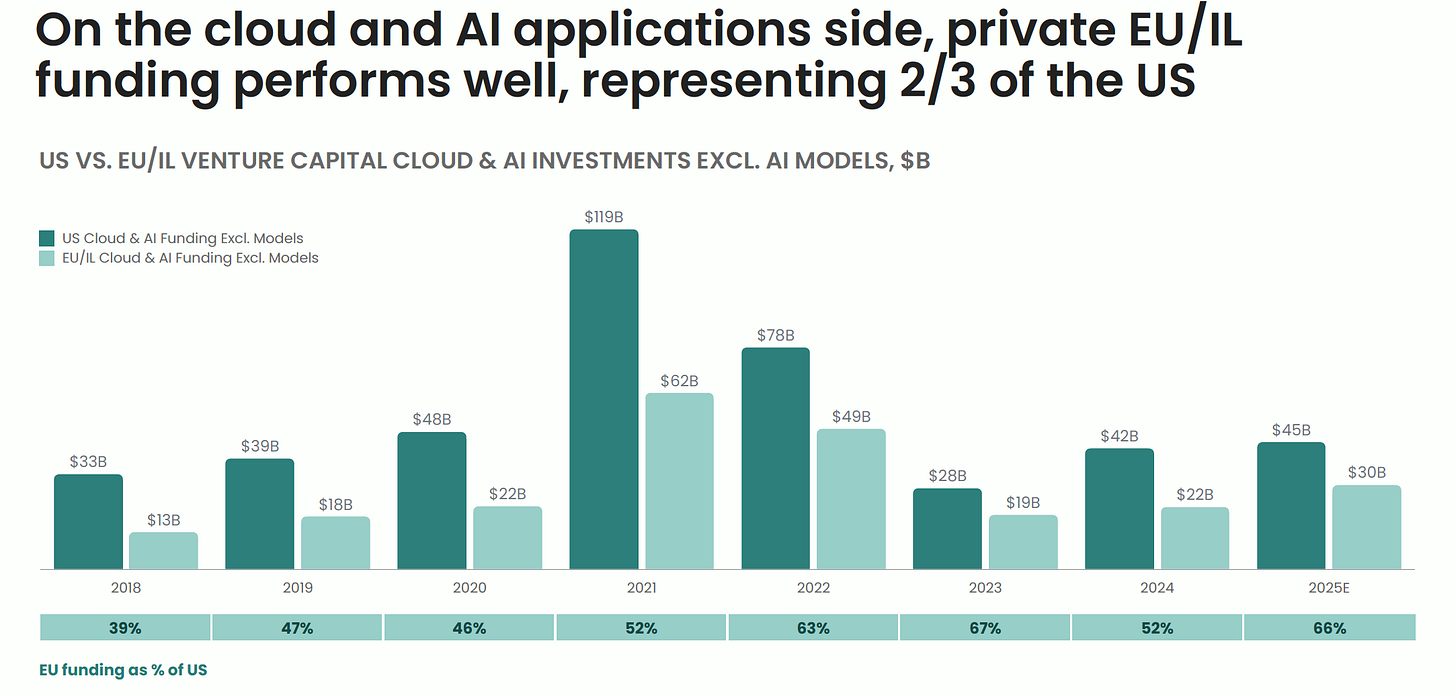

Now contrast that with European and Israeli startups. Depending on the year, EU/IL funding is between roughly half and two-thirds of US levels (for 2025, about 66% of US funding on an annualized basis.) Europe and Israel aren’t trying to outspend the US on frontier models, they’re channeling capital into AI-native products in verticals like healthcare, finance, security, and construction.

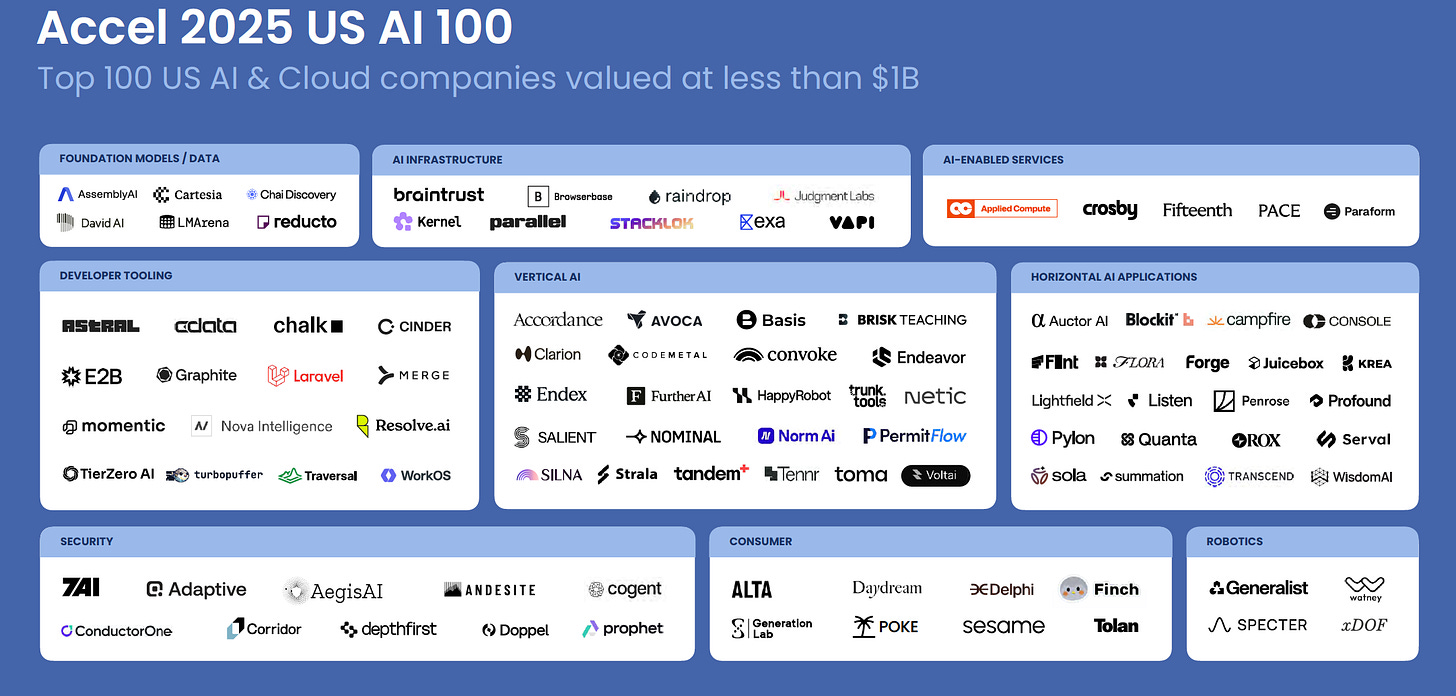

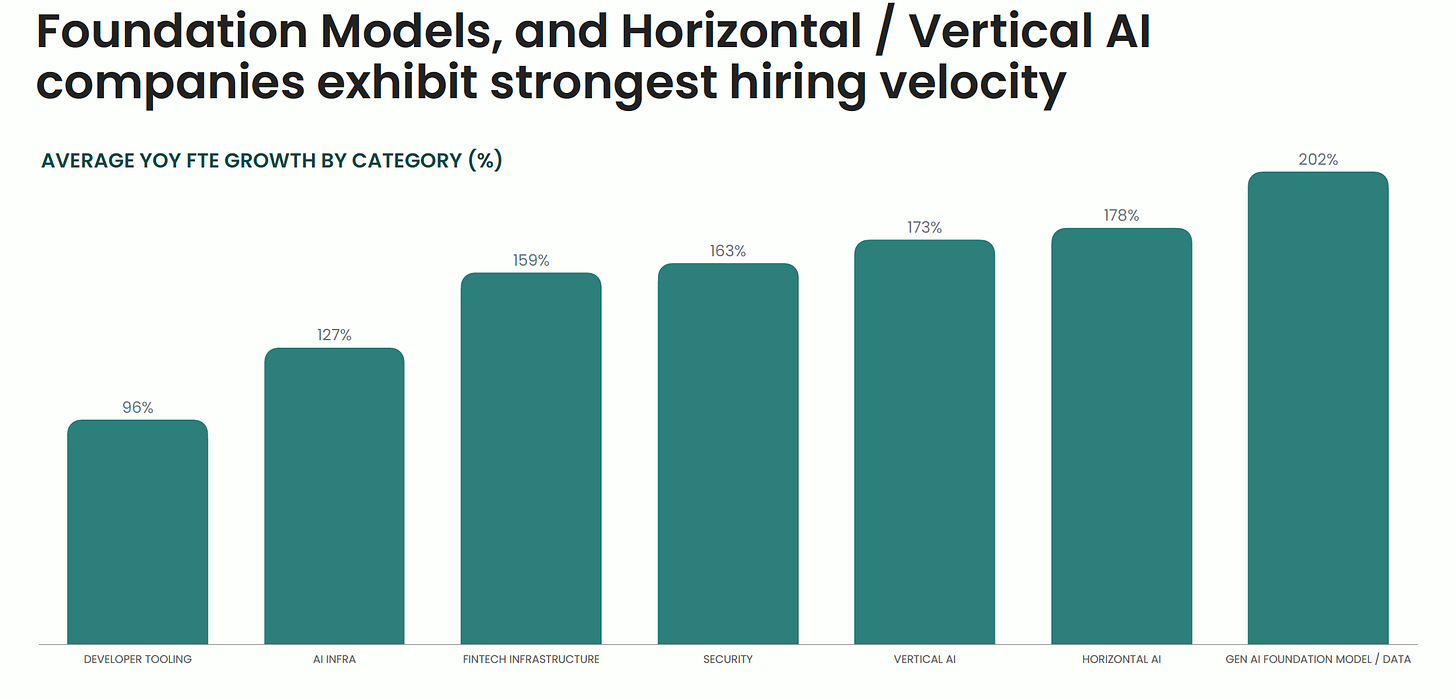

Accel’s Europe AI 100 and US AI 100 snapshots offer a great way to visualize the two different operating environments. The top 100 European and Israeli AI and cloud companies together employ about 10,400 people and have raised $5.4 billion in total funding, with an average age of around four years and roughly 104 employees per company. The US AI 100, by contrast, employs about 5,200 people on $4.8 billion of funding, with companies that are on average only 2.4 years old and 52 employees apiece, and they’re growing headcount much faster, with 213% average year-over-year FTE growth versus 122% for Europe and Israel.

In Europe and Israel, the typical breakout AI company is a little older, a little larger, and growing headcount aggressively but not insanely. That’s what a more sustainable hiring environment looks like: still fast, but not “triple the team every twelve months, and hope the culture somehow survives.” In the US cohort, where more than half of the winners are under three years old and headcount is more than doubling annually, the odds that your early employees stick around for the whole journey are much lower.

If you’re running an application-layer startup that has to ship real features to real customers, that stability matters. Every time a staff engineer walks out the door, they take months of context with them: weird edge cases from your largest customer, half-finished internal tooling, undocumented architecture decisions. Multiply that by a market where everyone is constantly interviewing and being interviewed, and you get an ongoing drag on execution that rarely shows up in pitch decks or funding charts.

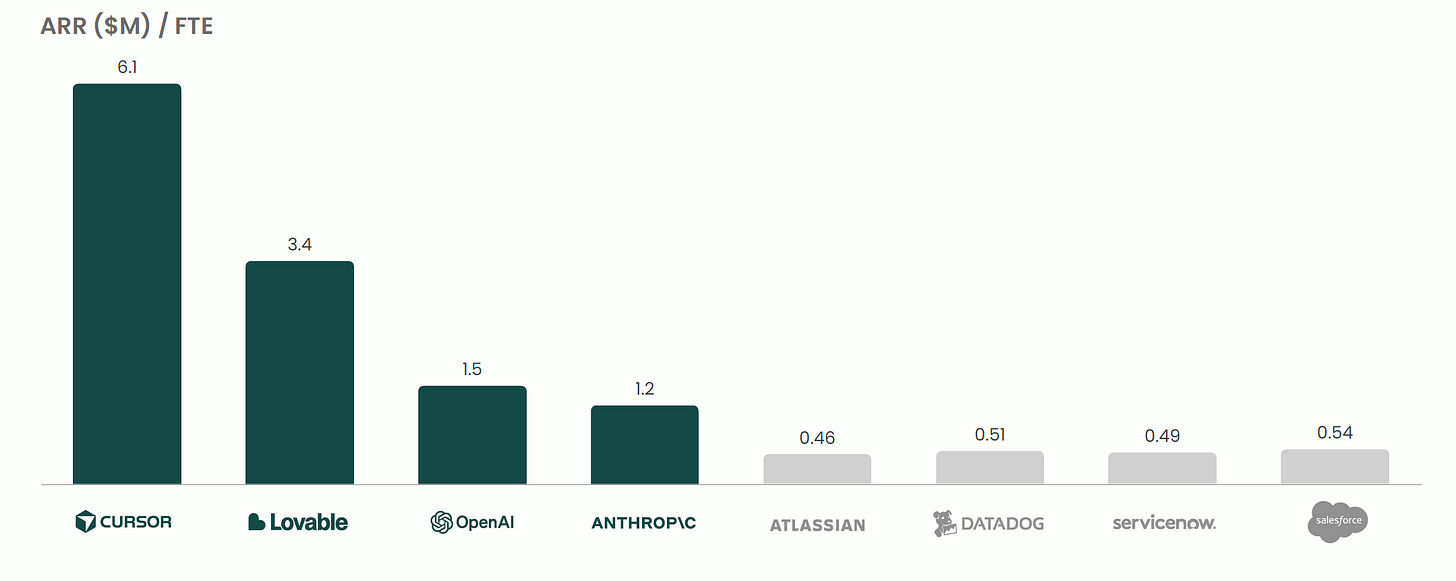

The Globalscape report also shows how fragile AI application economics still are. Even today’s standout AI-native application companies show ARR per employee far above traditional SaaS, but their gross margins are well below classic software benchmarks. Several are in the 10–40% range, compared with roughly 76% for the average public cloud company.

Why? Inference costs, bespoke integrations, heavy support workloads which are all the unglamorous realities of turning a clever model demo into a dependable product. The report notes that rapid declines in inference costs (OpenAI’s flagship models have seen more than a 90% drop in per-token pricing over the last few years) should help margins improve over time, but we’re not there yet.

In that environment, operating expense discipline is the only way to guarantee survival. If your compute bill is still chunky and your gross margin is 30%, you simply can’t afford to pay San Francisco frontier-lab salaries for every engineer and then lose a chunk of them to the latest model company round or “AI agents for everything” startup every 12–18 months.

This is where Europe’s smaller ASI hype tax becomes a strategic advantage. Because European model funding is lower and the compute race is less centered there, local application companies face less direct competition from homegrown hyperscale labs and fewer nine-figure frontier rounds bidding up the same talent pool. They still compete globally, of course but in practical terms, a Berlin-based AI vertical SaaS firm is not fighting OpenAI for engineers on the same street the way a Bay Area startup is.

Lower churn and less extreme salary pressure don’t just save cash, they preserve culture too. In a fast-moving domain like AI, institutional memory compounds: how you built your evals, how you debugged that silent model failure for a key customer, how you navigated the first wave of AI safety audits. Keeping the people who lived through those moments is a non-trivial balance-sheet asset.

The Globalscape report also makes clear that someone has to pay for the AI party. Accel estimates that paying back the expected 2026–2030 AI data center capex would require about $3.1 trillion in AI data center revenue over that period, enough to add roughly 1–2 percentage points to global GDP growth if it all materializes. That’s a massive macro bet on AI.

European application companies, by and large, are not the ones making that bet. They are the ones who will try to turn that infrastructure into specific business outcomes: shorter order-to-cash cycles, fewer denied insurance claims, faster permit approvals, more secure networks. The report’s What’s Next section is the Sears catalog equivalent of vertical European opportunity: AI-native tools for legal work, finance, construction, healthcare, AI security, voice and media for the enterprise, and vibe coding tools reshaping how software is built.

Being downstream of the hype has two big advantages.

First, you benefit from falling unit costs without absorbing the capex risk. As model performance converges and more players compete on inference price, application teams can shop around. They can move workloads between providers, use domain-specific models where they’re good enough, and keep their gross margins trending up as the infra world races to the bottom on price.

Second, you’re less exposed to the cultural and financial distortions that come with “we must be the first to ASI” thinking. You don’t need to hire a hundred researchers to work on hypothetical emergent capabilities; you need to hire enough engineers and product people to wire existing models into real processes in a robust way. That is still hard. But it rewards patience and execution more than it rewards hype.

Europe’s AI ecosystem, as Accel describes it, is starting to look like a place where those boring virtues can compound. The companies are older, the teams are bigger, and the headcount growth, while still ferocious by normal-industry standards, is not quite as vertiginous as in the US. In other words: there’s still hype, but less ASI hype tax.

And now, here are the week’s news:

❤️Computer loves

Our top news picks for the week - your essential reading from the world of AI

Wired: AI Relationships Are on the Rise. A Divorce Boom Could Be Next

Business Insider: AI hype could sideline Gen Z workers

Wired: All of My Employees Are AI Agents, and So Are My Executives

Bloomberg: When Employee AI Adoption Stalls Out, Workplace Influencers Get Called In

Business Insider: What one Big Law firm told 400 young lawyers about using AI

WSJ: The Political Left Is Dialing Up Scrutiny of Data Centers

Bloomberg: EU Plans to Streamline Data and AI Rules in Bid to Boost Business

Business Insider: OpenAI is weighing a move into consumer health apps

FT: ‘People like dealing with people’: Reed boss on the challenge of AI in hiring

WSJ: AI Is Upending Jobs. Corporate Tech and HR Are Teaming Up to Figure It Out.